Asset allocation is perhaps the single most important determinant of over/underperformance when it comes to delivering returns to investors. This has always been a complex endeavor, but it seems despite having seen a full spectrum of macro issues to digest over the last 30 years, the current factors at play today present especially difficult challenges for investors. This is because, unlike in the past where both equities and bonds benefitted from rising prices, over the last 9 or so months only commodities have seen price appreciation. Hence, traditional asset class investment approaches (equities/bonds), have not delivered the historic degrees of protection for investors over many years past. We have also commented that the traditional model for asset class diversification (60/40) is an outdated model that requires more sophisticated asset class optimization and the utilization of alternative strategies to achieve investor return objectives.

Before getting into what we believe are the main issues for investors (namely inflation and rates), I want to briefly provide some thoughts on asset allocation and the biases that exist for many allocators. This is important because in order for asset allocation to be effective, the process and perspectives ought to be grounded in objectivity and/or at least recognize the inherent set of biases that exist.

Franklin Roosevelt once said: “to reach port we must sail-sail, not tie at anchor-sail, not drift.”

Effective navigation, whether it is on the seas or in the markets obviously requires the acceptance of risks, but also a reference point upon which to measure where one is, and of course, well-calibrated (objective and precise) instrumentation.

One challenge in particular for financial market navigation is the notion that some data inputs are not necessarily objective and are full of inherent biases.

The two most influential biases are the media as well as the whole spectrum of the human cognitive biases. Both of these, in our opinion, distort effective asset allocation for most of the market participants.

First: media bias. This is not a political comment, it is a recognition that all media is inherently structured to gain viewers and keep them glued to the outlet, whatever that is. This is often achieved via a “shock and awe” approach.

I was recently at a conference for what I might describe as an elite audience of asset allocators, CIO’s for family offices, sovereign wealth funds etc., hosted by one of the most respected global macroeconomic research platforms (not sell-side research but more of an independent research organization). One of the commentors confessed that the job of all professional asset allocation writers is to, “scare the crap out of the audience.” Most of you get this. Media captures you by appealing to either your emotions of fear or of greed/hope. This is an inherent component of all forms of journalism because provocation and stimulating strong emotions sells content and baits the readers. I do not think that it is my job to add to the plethora of bait that is floating constantly in the sea of financial advice but will note that there seems to be a significant tilt towards downside risk factors in the markets today. This is more so the case in Europe where the list of fears outweighs the optimism compared to the US where there is a less bearish outlook. Nonetheless the list of risk factors on the minds of investors includes:

- The Russian/Ukraine conflict,

- Mounting China/US tensions,

- Energy availability in Europe,

- Global demographic challenges,

- Climate change risks,

- Earnings/recessionary risks,

- Tightening of monetary policy,

- USD strength and its impact on EM countries (and the rest of the world).

As a result, the foregoing sentiment indicators are predominantly bearish at present. They are oscillating day to day from mildly bearish to extremely bearish driven by new inflation data and headlines. Sentiment indicators at extreme levels tend to be contrary indicators, meaning when there is overwhelming bearish sentiment it is actually bullish and vice versa. The majority of sell side firms are predominantly bearish today. When there is such a consensus it is usually wrong in the sense that the bad news is “priced in” or fully discounted already which explains why the consensus at pivot points in the markets tends to be wrong.

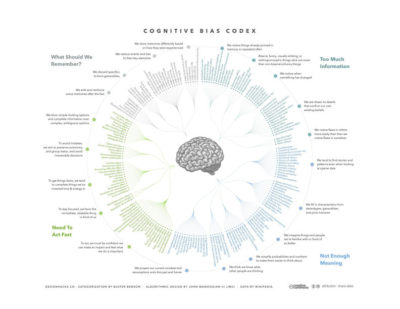

The second set of biases that influence asset allocation, in general, is the entire spectrum of cognitive biases.

I won’t go into the entire set of cognitive biases now but for those interested in seeing a great illustration of these sets of cognitive biases take a look at the link here.

I myself certainly am not immunized from cognitive bias nor are many if not all of the other market participants. But what I do believe is that this set of biases, coupled with the aforementioned media biases, translates into the notion that the markets are not often efficient. Downside risks when magnified or emphasized by the media coupled with the collective cognitive biases of the markets means that markets tend to misprice both optimism and pessimism in the prices of financial assets. Things get “overbought” during periods of optimism and “oversold” during periods of anxiety and pessimism.

So now onto the question of what our outlook for risk assets over the near-term contain.

In a previous writing I noted that risk assets (and non-risk assets, bonds) will continue to face headwinds (meaning a lack of advance in upward prices) as long as rates are increasing.

With the full recognition of the aforementioned biases, we think that the main issue is whether or not inflation and rates are peaking, or if further increases are fully priced or mispriced into the current valuations of financial assets.

What is generally agreed as the main issues and/or hurdles that the markets are trying to price are the following:

- A global recession is expected but it is debated whether this is a hard or a soft landing; Europe is almost universally bearish in sentiment whereas sentiment in the US is more positive.

- The conflict in Ukraine is not likely to be resolved anytime soon, meaning there is still a supply shock and diminished supply for energy and other commodities. With that said energy prices are not increasing at the rates of prior advances, meaning the worst may be over here or that the outlook for forward demand is expected to be weakening.

- Food prices are elevated and may remain so in light of what appears to be climate change factors that are wreaking havoc around the world on many levels.

- There is a continued shortage of skilled labor (and non-skilled), which is the one component of the inflationary input factor that seems to be stubbornly high; this may be corrected if a recession is orchestrated. Many tech companies are continuing to announce layoffs to reduce their burn rates in cashflow-negative companies. Further offsets to this labor shortage are technological solutions to productivity including more software, AI, robotics etc., plus extending the retirement ages in many countries to meet the labor shortfalls.

- The US Federal Reserve may not actually be behind the curve in fighting inflation but in fact is now starting to be viewed as an aggressive fighter of inflation (and may actually be ahead of the curve). The idea that rates will be hiked another 75 bps soon and another 50 bps afterwards seems to be priced into market expectations.

- China is facing a structural slowdown in consumer confidence due to weakness in the property segment and fears that if China were to increase its hostility towards Taiwan, that it too would face sanctions like Russia from the rest of the world. China also has a significant aging population issue that could be addressed by raising the retirement age.

- European confidence is very low, and anxiety is high largely due to extreme concerns on gas availability through the winter. A European recession is most likely already priced into financial assets in these markets which are comprised of a heavier set of companies that are “cyclical in nature.”

- The US money supply, a broad liquidity index, is shrinking not expanding. It is widely appreciated that the initial catalyst for inflation was the seed sowed after the pandemic when the world’s central banks flooded the world economic engine with liquidity, among others. Now, this infusion is in reversal and the US Federal Reserve has taken a firm line in fighting inflation and will not capitulate on rate hikes until it is assured that inflation has been contained. Money supply is hence shrinking, and this is a precursor to falling inflation.

- US housing industry is facing a need for a price correction because the differential in the cost to own versus the cost to rent is at a peak. Observers do not expect a bubble burst in housing but a move down in prices that is contained. Since housing is a large part of the US economy, this force is likely to alleviate inflationary pressures.

- Demographics in the developed world (declining populations in developed markets) are deflationary in the sense that aging populations almost everywhere are likely to be a force that keeps interest rates contained.

- The USD strength against almost all other currencies in the world is understood as a safe haven-driven rally coupled with the fact that holding USD offers a significant positive interest rate differential. A super strong dollar is a headwind for emerging market companies with USD-denominated debt, but it is tailwind for companies that export to the US markets.

While an investor could have a high conviction of the probability of all the above “forecasts” and actually be right about them happening, could also be absolutely wrong in the allocation of capital. What this means for example is that if one is bearish on Europe and the reasons to be bearish prove correct, it does not mean that one would be right by not investing in Europe if the bearish view was so widely accepted that it is fully discounted and priced into financial assets. What moves financial asset prices therefore is hence the marginal thing that is not priced in.

Our interpretation of all of the above factors is that we are soon (next 6-9 months) likely to be approaching an end of the bear market for equities and financial assets.

This premise largely rests on the notion that we believe inflation is soon likely to reach peak levels and that interest rates (while still may have further near-term upside) are also likely to peak soon. Today the US “printed inflation data” that showed it was not abating and equities sold off as a result. Here we note that inflation data is a backward-looking indicator and not what economists would call a “leading indicator.”

We believe that a new bull market for risk assets will start when rates stop rising or that the expectation of rate increases is fully priced into investor expectations. We think we are at the beginning stages of this but also note that it might take another “wash-out capitulation-driven catalyst” to set the bottom.

We are in the camp that there are more factors contributing to the longer-term containment of inflation than factors that contribute to it being a runaway risk factor.

The main reasons for this view longer-term are the demographic conditions of the world (less spending), the likelihood of technology and innovation keeping pressures on prices enhancing productivity and the belief that the Fed and other Central Banks are acting with conviction to contain the inflation risk by aggressively shrinking global money supply.

Timing markets is of course a dangerous and very challenging skill which few people can claim sustainable advantages especially in the short-run. Accordingly, we emphasize longer-term perspectives, and utilize longer duration strategies such as private equity, given that the majority of our clients are endowments and foundations with almost perpetual durations.

We want to be prepared for investing ahead of the next wave of leadership companies and themes that drive long-term capital appreciation and believe that the companies and industries that will prosper will be innovative companies that are rich in human capital or what we call the Knowledge Economy. Our emphasis on strategies in the lower middle-market private equity arena with thematically focused strategies is central to the positioning of being ahead of these next generation of leaders.

Just like the pandemic and the world’s lock downs propelled many technology solutions and business models towards faster adoption, we also believe that the current challenges in the world, whether they are inflationary forces, demographic challenges or the climate change challenges, are all hurdles that will be faced with human ingenuity and innovative solutions that are born in such adversity.

As Plato famously wrote in the Republic: “our need will be the real creator” which over time evolved into the English proverb “necessity is the mother of all invention.”

by David Pinkerton